Sep 15, 2020

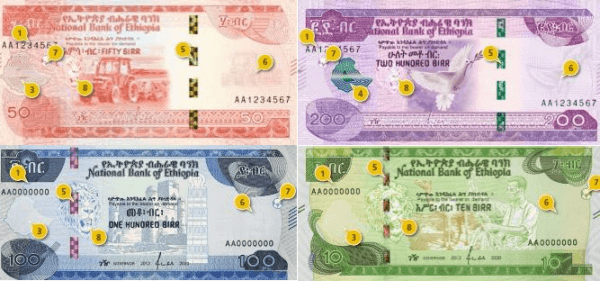

The Ethiopian government has unveiled a set of new

bank notes as a part of its efforts to curb cash hoarding, illegal trade

activities, and illicit financial flows in an already struggling economy.

Prime minister Abiy Ahmed disclosed the notes with

denominations of five, 10, and 100 are changed, and a new 200 birr (~$5.50)

note is being introduced. Over 3.6 billion Ethiopian birr ($97 million) is

being spent to print the new currencies. Ordinary Ethiopians have just three

months to replace their old notes.

“Money outside the banking system has been rising,

affecting the liquidity of commercial banks. This is in addition to its impact

on bolstering illegal trade activities”, said Abiy in a statement.

Local banks have long called for a change in

currency via Ethiopia’s Bankers Association noting that over 113 billion

Ethiopian birr lives outside of the formal banking system exacerbating the

liquidity problems commercial banks have faced this year.

“Even though changing currency is costly and

expensive, it is very important to the economy,” says Wasihun Belay, a

development economist based in Addis Ababa. “Especially with the inflationary

pressure haunting the country for long and its adverse impact on purchasing

power, introducing new denomination is a step in a right direction and, in

addition, 500 and 1000 notes should also be introduced,” he says.

Although demonetization is an economic strategy used

from time to time in developing countries to stabilize the currency and ease

inflation it is not without its risks. Economists often warn if mishandled it

could trigger market chaos and uncertainty as citizens scramble to swap their

notes.

Ethiopia last introduced a new denomination at the

end of the Ethiopian-Eritrean deadly civil war two decades ago.

The government has in recent years been forced to

print currencies to finance its budget deficit only sustained by foreign

lenders. Broad money supply has been increasing by 20% annually according to

the National Bank of Ethiopia over the last 15 years and skyrocketed from 104.4

billion Ethiopian birr to almost 1 trillion birr this year.

Although this has helped the economy grow by raising

the contribution of the state through massive infrastructural investments, it

has resulted in an increase in cost of living. Last month, inflation rate

topped 20%. Like most developing economies, Ethiopia has been harshly hit by

the pandemic. After several years of rapid growth the World Bank and IMF have

had to downgrade their forecasts annual growth of 3.2% down from 7.2%. In

May, the country’s debt was downgraded to B2 from B1 after it stated its

intention to take part in the G20’s Debt Service Suspension Initiative designed

to help low income countries focus on healthcare for their citizens.

Most transactions in Ethiopia are still cash-based

as the informal sector has a substantial share in the economy. To get round

this, the National Bank introduced a cash withdrawal and limits on withdrawal

as of last month.

“The introduction of new currency would be instrumental to reduce cash-based transactions,” says Yinager Dessie, governor of the National Bank.